The landscape of cryptocurrency mining is poised for significant changes as we head into 2025, especially concerning the impact of electricity prices. As the world steers towards greener energy solutions, the cost of electricity remains a critical factor for mining operations, influencing profitability for both small-scale miners and large mining farms alike. The debate surrounding energy consumption in mining continues, and it highlights the importance of electricity prices in determining where and how effectively cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG) are mined.

Cryptocurrency mining is an energy-intensive process. Miners deploy specialized hardware known as mining rigs to solve complex mathematical problems, which in turn validate transactions on the blockchain and generate new coins. The most famous of these is BTC mining, which demands significant computational power and thus, energy consumption. As electricity prices fluctuate, miners either see their margins increase or decrease, forcing them to adapt or potentially phase out their operations.

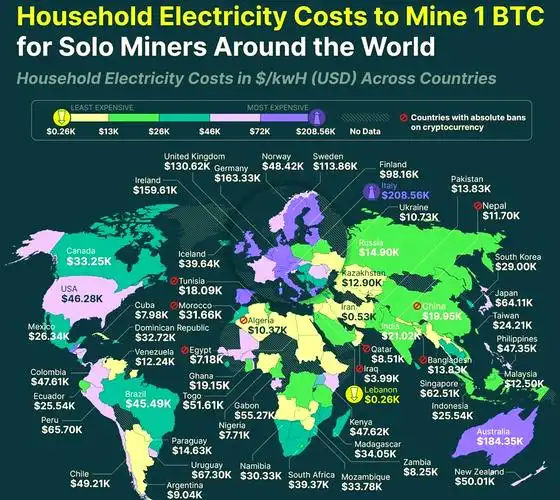

In regions where electricity costs are low, mining farms thrive, establishing expansive operations that harness economies of scale. For instance, places with abundant hydroelectric power or naturally cool climates reduce the costs associated with cooling systems, essential for the high-performance mining rigs. Conversely, in areas where electricity is expensive or regulations tighten around power consumption, smaller operations struggle to maintain profitability. This dynamic can drive miners to seek hosting services that offer competitive electricity rates, ensuring they remain viable players in the ecosystem.

Electricity is not just a commodity; it is a primary determinant of operational strategy within the mining industry. The rise of renewable energy sources introduces new variables into this equation. Miners are increasingly exploring partnerships with solar farms or wind energy providers to secure more favorable rates, mitigate price volatility, and promote sustainability. This shift doesn’t merely represent a reaction to rising costs; it encapsulates a broader trend where the cryptocurrency sector aligns itself with environmental considerations, a crucial factor for legitimacy and acceptance in the mainstream financial world.

Moving forward, it is essential to address the potential impacts of an energy transition in various regions. For instance, increased investment in solar and wind infrastructure may eventually bring energy prices down globally, providing a breathe of relief for miners initially hindered by excessive costs. Furthermore, the emergence of innovative financing models that leverage advanced energy storage solutions could provide miners with new opportunities to optimize their operations amidst shifting market dynamics.

While BTC mining has dominated headlines, the burgeoning market of alternate cryptocurrencies (altcoins) such as ETH and DOG presents unique challenges and opportunities as well. The diversity of algorithms and mining methods means that electricity price impacts can vary widely from one coin to another. For instance, Ethereum’s planned transition to a proof-of-stake (PoS) model changes the mining landscape entirely, moving it away from energy-intensive proof-of-work systems, maintaining lower operational costs for miners in this ecosystem.

As we delve deeper into 2025, it’s anticipated that the cryptocurrency exchanges that stand resilient amidst electricity price volatility will be those that adapt quickly to these changes. Hosting platforms for miners must remain aware of global trends in energy procurement, including developments in both centralized and decentralized electricity markets. Those who can secure stable, cost-effective energy sources have a competitive edge in enabling their clients to maximize returns on their mining machines and rigs.

Moreover, the interconnectedness of mining operations with broader economic metrics cannot be ignored. Cryptocurrency price trends directly impact mining profitability, and as electric costs rise, miners may become hesitant to scale their operations, potentially leading to decreased hash power across the network. This decline can have far-reaching implications on security and transaction speeds for networks, affecting everything from investment decisions to user adoption rates.

As fluctuations in electricity prices evolve, miners and hosting providers must stay resilient and adaptable. Versatile pricing models, such as flat-rate contracts based on predicted energy usage, may emerge as viable options to cushion miners from sharp price spikes. Addressing these intricacies effectively won’t just safeguard miners’ interests; it will nurture a stable cryptocurrency ecosystem overall, promoting broader acceptance and innovation in the financial tech landscape.

Leave a Reply